At HDFC Bank , our primary focus has always been our people. The organization harbours a culture of meritocracy to support an environment that nurtures young talent transforming them into the young leaders of tomorrow. Keeping this legacy alive, we present to you the Future Bankers Program, designed to make you future ready!

![]()

To equip aspirants with the necessary skillsets to build long term careers in Banking and help build a future ready talent pipeline to achieve the Bank’s objectives.

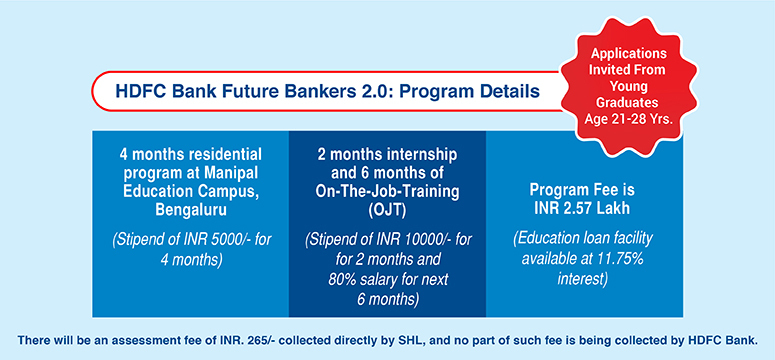

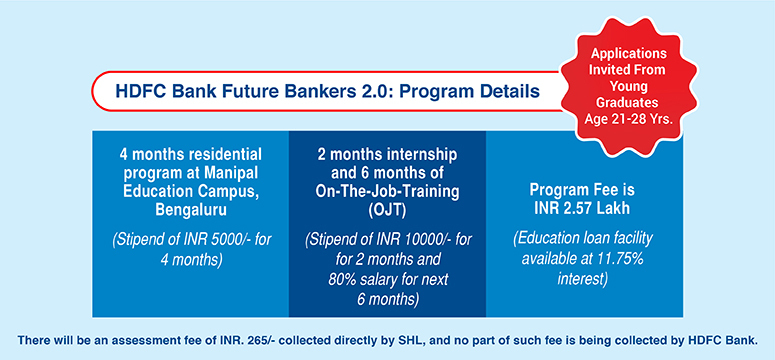

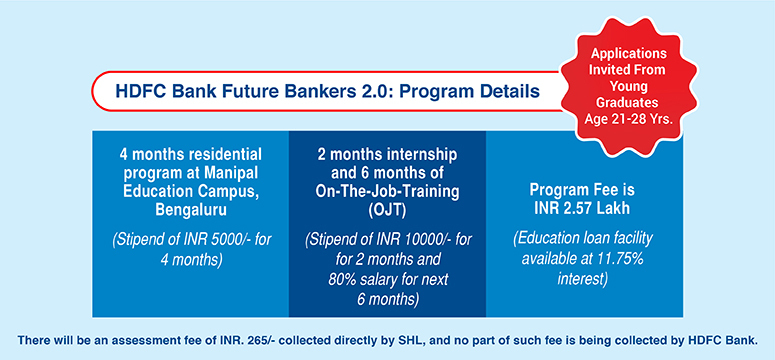

Programme Fees

INR 2.57 Lacs (incl. taxes)

Including (4 months accommodation)

Learn everything you need with :

4 months at Manipal

campus, Banglore

2 months Internship at

any HDFC bank branch

6 months On the job

training at any HDFC bank

branch

Earn while you learn!

Future Bankers Program -2.0 is a 1 year professional diploma program by HDFC Bank in collaboration with Manipal University, one of India’s leading educational institutions. This program has been structured to provide a “real world” experience to future banking aspirants.

![]()

![]()

Not only that, you get paid to learn!

![]()

A 08 month paid Internship+OJT at any of the HDFC Branch locations within the country to further strengthen your grounding in banking products, processes, compliance framework and day-to-day banking operations

![]()

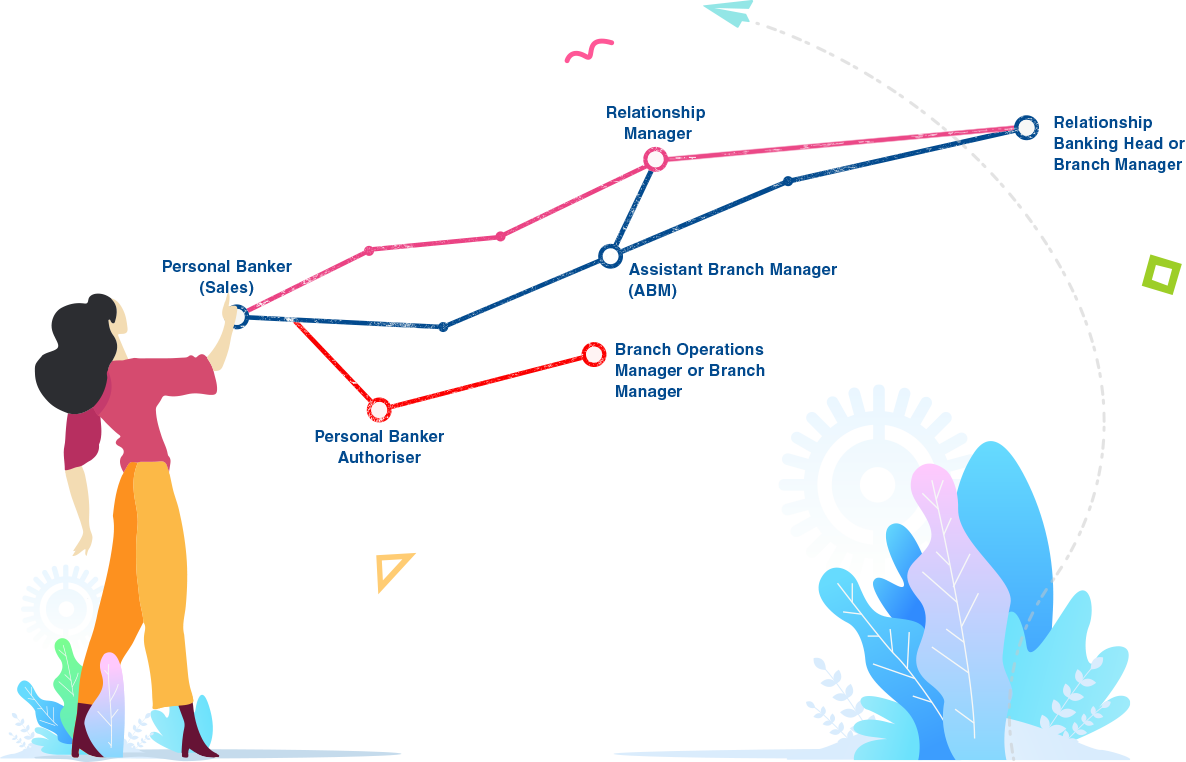

Job Opportunity as a Personal Banker at the grade of Deputy Manager with HDFC bank on successful completion of the course

![]()

A Post Graduate Diploma in Sales & Relationship Banking

“Sales is contingent upon the attitude of the salesman, not the attitude of the prospect.”

-William Clement Stone

![]()

The program has been structured to specifically create a pool of first level bankers. It equips aspirants with the skill sets and the knowledge required to step into the real world with utmost confidence.

![]()

The placement opportunity of the programme gives young minds an opportunity of accelerated growth and seamless transition into the workforce.

![]()

The program concentrates heavily on the more practical aspects of learning making it more professional than other programs in the same category.

![]()

This is a once-in-a-lifetime opportunity for individuals to become a part of HDFC bank , one of India’s foremost brands reputed for its rich legacy of innovation, transparency and honesty.

![]()

At INR 2.57 lacs (incl. taxes) which includes boarding charges for the first 4 months of on-campus training, the program is immense value for money as compared to other professional courses in the same category.

![]()

Course fee refund within 2-3 years

![]()

Year course

with knowledge of banking processes & real word experience

![]()

Years of theory

with very limited practical application

![]()

Earn while you Learn

Stipend paid throughout the course

![]()

No earning

during the course of the program

Less than market

rates (11.75%)

Customized Educational Loans at less than market rates

[While there is a customized Education Loan, candidate may avail an Education Loan from any other Financial Institution of their choosing.]

Higher Education

Loan interest rates

& stricter repayment timelines

HDFC Bank is a young and dynamic bank, with a youthful and enthusiastic team determined to accomplish the vision of becoming a world-class Indian bank. We’d like you to come Join the Winning Team!

Customer

Customer  Operational

Operational  Product

Product  People

People Sustainability

Sustainability

Josh is the Bank’s sporting extravaganza! Initiated in the year 2012 in 8 cities, Josh has now expanded to 29 cities PAN India.

Hunar is the Bank’s in-house talent hunt. Give yourself and your colleagues an opportunity to unwind in the midst of busy work schedules.

Initiated in 2015, Xpressions is a theme based art competition that you can participate in with your families.

The Wanderers initiative helps you get back in touch with nature through monsoon treks, nature trails & adventure sports.

At HDFC Bank, progress isn’t simply about moving with the times. It is about ushering in ‘Parivartan’ - a transformation that improves lives and empowers communities.

We’ve been privileged to enjoy success over the last quarter of a century. But this success would be hollow if we didn’t use our resources to give back to society. This is the founding principle of Parivartan and the cornerstone of our CSR efforts. Today, our commitments in the field have made us one of the largest spenders on CSR in the country. Through our efforts, we have impacted 54 million lives so far.

The Five Pillars of Parivartan

We work with marginalised communities to understand their unique needs, and then formulate customised strategies to bring forth the Parivartan they need.

1. Rural Development

The Holistic Rural Development Programme (HRDP) is a flagship programme under rural development. It attempts to provide rural communities, with the tools and means to grow and prosper. HRDP’s various initiatives in areas such as educational infrastructure, healthcare, and natural resources management including micro-watershed management, irrigation, soil and water conservation, represent our attempts to usher in meaningful and impactful change where it matters the most.

Today, HRDP spans across 17 states and has reached over 3.6 lakh households in more than 1,100 villages. We have set up over 1,200 schools, and facilitated better learning opportunities for over 1.45 lakh students. We have also trained over 72,500 farmers, distributed more than 10,800 biomass stoves and set up over 460 libraries.

2. Promotion of Education

We believe that a quality educational foundation is a gateway to better opportunities and success. This is why we strive to provide and promote a conducive and effective learning environment. The Zero Investment Innovations for Education Initiatives (ZIIEI), is a large scale teacher outreach initiative started in 2015 by HDFC Bank in partnership with Sri Aurobindo Society.

ZIIEI aims to find solutions created by teachers at the grassroots level and systematically scale them up to millions of students through the 'Navachar Pustika' or Book of Ideas, which is a compilation of the best ideas selected and recognized by a panel.

The ZIIEI programme today has touched more than 15 lakh government teachers across 21 states and indirectly reaches out to more than 1.6 crore students to ensure quality education and bring innovation in the country’s education system.

Our Educational Crisis Scholarship Support (ECSS) programme provides support to children undergoing personal and economic exigencies, those who are most at risk of dropping out of school due to poor financial conditions. The ECSS programme covers students in middle schools and high schools, as well as scholars pursuing undergraduate and postgraduate education.

3. Skill Development and Livelihood Enhancement

We at HDFC Bank, have provided training in fields such as communication skills, agriculture techniques, livestock management among others. We hope to expand and diversify this portfolio in the years to come and strengthen our focus on rural youth and women. As of today, we have served over 1.24 lakh individuals and empowered over 7.65 lakh women, helping them access entrepreneurship and employment opportunities.

Sustainable Livelihood Initiative: Empowering women through financial inclusion

Through this initiative we have reached out to over 96 lakh households across 27 states through credit facilities, financial literacy and capacity building programmes. The primary objective of SLI is to bring about Parivartan by creating sustainable communities. This is done by helping women in rural areas break away from the vicious cycle of financial dependence to one of growth and opportunities. Run by over 10,000 dedicated bank employees, it provides women with a range of financial and non-financial services.

4. Healthcare and Hygiene

Under our interventions in healthcare and hygiene we have conducted over 1,500 sanitation drives and have helped build over 22,490 sanitation units of which 6,954 units have been built in schools and 15,537 in individual households. Through our various other initiatives within the programme, such as the ‘Swachhata and You’ campaign, we have dedicated ourselves to community-led sanitation and health campaigns. These campaigns help raise awareness about nutrition, healthcare and hygiene in rural areas, and contribute towards a cleaner, healthier nation. Our health camps have reached out to 86,000 people so far.

5. Financial Literacy and Inclusion

In a world that operates on the exchange of goods and services for money, communities cannot progress and interact with the world at large, without basic financial literacy and inclusion. We understand this, which is why we have taken on the responsibility to spread financial awareness, by running workshops to empower the marginalised sections of society. As on FY 2018-19, the initiative saw more than 8.1 million participants benefit through workshops held at literacy camps and banking outlets.

The flagship project of Digidhan or Dhanchayat has been one of our most fruitful initiatives. This Literacy Programme-on-Wheels takes financial literacy to people who do not have access to regular venues. These vehicles are equipped with micro-ATMs and biometric facilities to enable instant account opening and Know Your Customer (KYC) processes.

as of March 2019

Holistic Rural Development Programme (HRDP): 1000+ villages/3.5 Lakh Households

HRDP is a testament to our effort to help bridge the India-Bharat divide. The Bank is working across villages to bring about a sustainable change in the areas of healthcare & hygiene, financial literacy and natural resource management. So far, HRDP has reached 1000 villages across India touching more than 3.5 lakh households. Read More

Sustainable Livelihood Initiative: 90 Lakh Households

Sustainable Livelihood Initiative (SLI) as the name suggest is one of the largest initiative of its kind aimed at women in the bottom of the pyramid in India. Under SLI, the Bank has already made close to 90 lakh women across thousands of villages financially independent. This financial empowerment not only benefits the womenfolk, but also their families. Thus, the Bank has been able to make a difference in the lives of close to 3.5 crore Indians in rural India through SLI. Read More

Teaching-the-Teachers’ (3T) programme: Benefitting 14 lakh teachers and 1.6 crore students across 6 lakh Government schools.

Under education, HDFC Bank runs the Teaching-the-Teachers (3T) programme. The objective here is to unravel the innovation streak among school teachers in India to enable them to impart education in a more dynamic and creative manner.

Teachers are an important part of the Nation building process, for it is education that creates the most significant impact in the overall economic and social development of society.

Under 3T, more than 14 lakh teachers across 18 states have been trained by inviting ideas from them. Read More

HDFC Bank Parivartan Blood Donation Drive: 10 Lakh Units (2018)

Under Parivartan, HDFC Bank conducts one of the largest single-day blood collection drives by corporate India. This effort has also been recognized by the Guinness Book of World Record in 2013. In the 12th edition of the drive last year, over 16000 camps helped collect over 10 lakh units of blood. Read More

We believe financial literacy is the first step toward real financial inclusion. Through its various initiatives HDFC Bank has impacted over 19 lakh lives

Employees are encouraged to contribute as much as they want to from their salaries to support any NGO of their choice empanelled with Give India. The Bank then matches their contribution to the same NGOs

ZIIEI is a mass-scale teacher outreach initiative started in 2015 by HDFC Bank. ZIIEI aims to find 'the scattered, isolated and unrecognised, but effective solutions' created by teachers at the grassroots and systematically scale them up to lakhs of schools every year.

HRDP, Parivartan’s flagship programme, aims to bring about holistic development in target villages through multiple interventions in education, skill training and livelihood generation, natural resource management, water and sanitation and financial inclusion and literacy.

The Bank conducts an Annual Blood Donation Drive which has been recognised by the Guinness Book of World Records as the largest effort of its kind, for collecting the highest units of blood in a single day.

Complete

Application Form

Pay Assesment Fee

to our partners

SHL India

Take Online

Assessment

Copyright © 2019 HDFC Bank Ltd. All rights reserved. See Privacy Policy

Effective date: 1st March, 2019

SHL India, Pvt Ltd. (“SHL India”, “we”, “us”, “our”), recognizes the importance of protecting your privacy and your personally identifiable information (“Personal Information”) collected through our AMCAT, SVAR, Automata, Autoview, Writex, and Video Interview web, myamcat.com applications and our AMCAT, Automata, SVAR, Autoview, and Interview Management mobile applications (the “Apps”). This Privacy Policy ("Policy") explains how we will collect and process your Personal Information in the Apps.

Data Processor

In the context of this Policy, SHL India acts as a data processor for the Personal Information we process.

Information We Collect

We may collect the following Personal Information about you (wherein “you” refers to students, candidates, and other data subjects using the Apps provided by SHL India Pvt Ltd):

How We Receive Personal Information

We may receive your Personal Information when:

How We Use Your Personal Information

We use your Personal Information for the following purposes:

In addition, SHL India Pvt Ltd may automatically collect certain non-personally identifiable information to:

Cookies

A “cookie” is a small file stored on your device that contains information that may be associated with you. We may use cookies for session management. If you would prefer not to accept cookies, you can alter the configuration of your browser to reject all cookies or some cookies. Note, if you reject certain cookies, you may not be able to access all of our Apps’ features. For more information, please visit https://www.aboutcookies.org/.

Disclosure of Your Personal Information

We disclose your Personal Information to certain third parties with whom we have a direct or indirect business or contract relationship, to provide the products and services you have requested.

We may use third-party vendors to perform certain services for us or on our behalf, such as hosting our Apps, or providing us with IT services. We may share your Personal Information with these third-party vendors solely to enable them to perform such services for us. In providing such Personal Information, we require that those third-party vendors maintain at least the same level of data protection that we maintain for such Personal Information. We do not provide your Personal Information to parties unconnected with the services we provide.

We may also disclose your Personal Information:

If we must disclose your Personal Information in order to comply with official investigations or legal proceedings initiated by governmental and/or law enforcement officials, we may not be able to ensure that such recipients of your Personal Information will maintain the privacy or security of your Personal Information.

We reserve the right to use, transfer, sell, and share aggregated, anonymous data, which does not include any Personal Information, about our services' users as a group for any legal business purpose, such as analyzing usage trends and seeking compatible advertisers, sponsors, clients and customers.

Child Privacy

Our Apps are not directed at nor intended for use by children under the age of 13. We do not knowingly allow anyone under 18 to provide any Personal Information on our Apps. Children should always get permission from a parent or guardian before sending Personal Information over the Internet. If you believe your child may have provided us with Personal Information, you can contact our Privacy Officer using the information in the Contact Us section of this Policy and we will delete the Personal Information, or notify our client so that they can delete the Personal Information.

Data Security and Integrity

SHL India Pvt Ltd has implemented and will maintain technical, organizational, and physical security measures that are reasonably designed to help protect Personal Information from unauthorized processing, such as unauthorized access, disclosure, alteration, or destruction.

Data Retention

When the purposes of processing are satisfied, we will retain your Personal Information for up to 1 year unless instructed otherwise by our client.

Erasing, Accessing, Changing, or Updating Your Personal Information

If you are a data subject about whom we store Personal Information, you may have the right to request access to, and the opportunity to update, correct, or delete, such Personal Information. To submit such requests or raise any other questions, please contact the organization you were assessed for as part of recruitment process and they will reach out to SHL India Pvt Ltd Team for the same. If you registered directly with us on myamcat.com, kindly reach out to us on privacysupport@shl.com

Changes

SHL India Pvt Ltd reserves the right to change this Policy. If we make any material change to this Policy, we will post the revised Policy to this web page and update the “Effective” date above to reflect the date on which the new Policy became effective. By continuing to use our Apps after we post any such changes, you accept the Privacy Policy as modified.

Dispute Resolution

If a privacy complaint or dispute cannot be resolved through SHL India Pvt Ltd.’s internal process, SHL India Pvt Ltd. has agreed to participate in the VeraSafe Privacy Shield Dispute Resolution Procedure. Subject to the terms of the VeraSafe Privacy Shield Dispute Resolution Procedure, VeraSafe will provide appropriate recourse free of charge to you. To file a complaint with VeraSafe and participate in the VeraSafe Privacy Shield Dispute Resolution Procedure, please submit the required information here: https://www.verasafe.com/privacy-services/dispute-resolution/submit-dispute/

Binding Arbitration

If your dispute or complaint can’t be resolved by us, nor through the dispute resolution program established by VeraSafe, you may have the right to require that we enter into binding arbitration with you

Regulatory Oversight

SHL India Pvt Ltd. is subject to the investigatory and enforcement powers of the United States Federal Trade Commission.

Contact Us

If you have a complaint, dispute, or questions regarding this Policy or our treatment of your Personal Information, please write to us by:

Mail:

SHL India Pvt Ltd.

Valley Towers

75 E Santa Clara St, San Jose

CA 95113, USA